Curious About the Housing Market in 2025? Here’s What You Need to Know!

If you’re wondering where the housing market is headed in 2025, there’s some good news. Experts are sharing optimistic forecasts, particularly regarding two crucial factors: mortgage rates and home prices.

Whether you’re considering buying or selling, here’s a look at what the experts predict and how it might affect your plans.

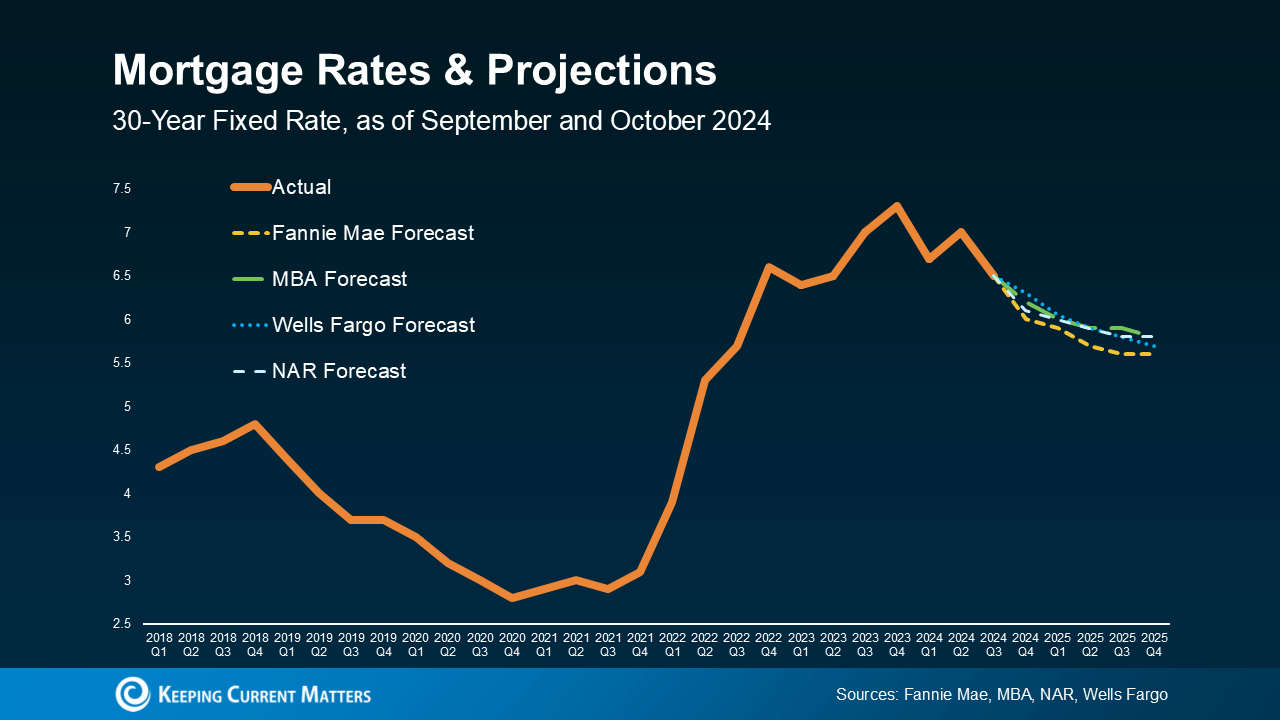

Mortgage Rates Are Expected to Drop

Mortgage rates significantly impact your decisions, and the outlook is positive. After a period of sharp increases, experts anticipate a gradual decrease in rates throughout 2025 (see graph below):

source: Keepingcurrentmatters.com

While the decline won’t be linear, the overall trend should be downward. Expect some fluctuations along the way, as rate changes will depend on economic data and inflation reports. However, it’s essential to focus on the big picture rather than getting caught up in short-term market reactions.

Lower mortgage rates mean improved affordability. As rates decline, your monthly mortgage payment decreases, giving you more flexibility in your home-buying budget.

This shift is likely to attract more buyers and sellers back into the market. As Charlie Dougherty, Director and Senior Economist at Wells Fargo, notes:

“Lower financing costs will likely boost demand by pulling affordability-crunched buyers off the sidelines.”

As more buyers enter the market, competition will increase. The takeaway? You can get ahead of the competition now. Rely on your agent to help you understand how shifts in rates are impacting demand in your area.

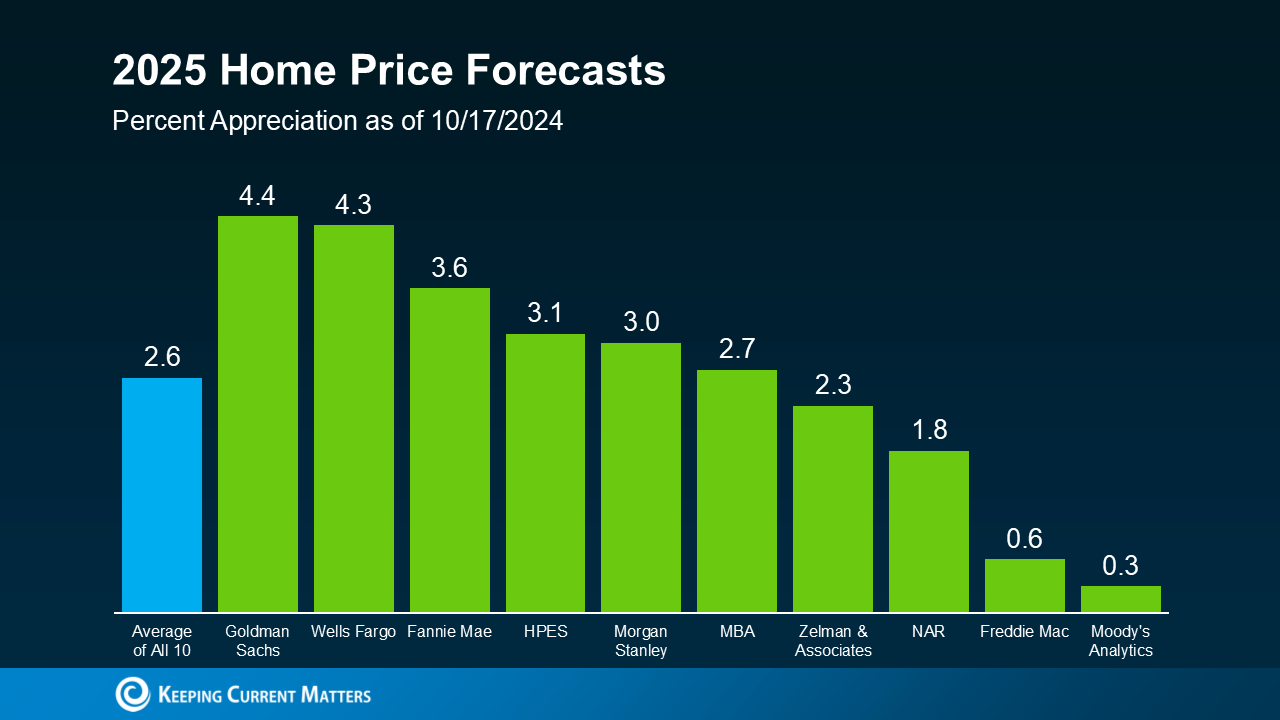

Home Price Projections Show Modest Growth

While mortgage rates are expected to fall, home prices are projected to rise, albeit at a more moderate pace compared to recent years.

Experts forecast a national average increase of about 2.5% in home prices for 2025 (see graph below):

source: keepingcurrentmatters.com

This growth is much more manageable than the double-digit increases some markets experienced in recent years.

What drives this ongoing price increase? Primarily, it’s about demand. As more buyers re-enter the market, demand will rise. At the same time, increased listings from sellers feeling less rate-locked should help balance things out.

More buyers in a market with still-below-normal inventory will exert upward pressure on prices. However, the anticipated increase in supply will help keep price growth in check. This means that while prices will rise, they’ll do so at a healthier and more sustainable rate.

Keep in mind that national trends might not reflect your local market. Some areas may see faster price growth, while others could experience slower gains. As Lance Lambert, Co-Founder of ResiClub, explains:

“Even if the average national home price forecast for 2025 is accurate, some regional housing markets could see mild price declines, while others may still experience elevated appreciation. That has been the case this year.”

Even in markets where prices might remain flat or slightly decline, past appreciation means it may not significantly impact overall value. That's why it's vital to collaborate with a local real estate expert who can provide insights tailored to your area.

Bottom Line

With mortgage rates projected to decrease and home prices expected to rise at a more moderate pace, 2025 looks promising for both buyers and sellers.

If you have questions about how these trends could impact your plans, feel free to ask me. Our team is here to help you navigate the market and seize upcoming opportunities.

Source: https://www.keepingcurrentmatters.com/2024/10/21/what-to-expect-from-mortgage-rates-and-home-prices-in-2025/